South carolina law encourage s the development and use of indigenous renewable energy resources renewable energy which includes biomass wind solar hydropower geothermal and hydrogen derived from renewable sources can mitigate south carolina s dependence on imported energy and help meet state air quality goals.

South carolina solar tax credit legislation.

Credits are usually used to offset corporate income tax or individual income tax.

South carolina solar energy tax credit.

South carolina s tax credits may be earned by individuals c corporations s corporations partnerships sole proprietors and limited liability companies.

Energy information administration south carolina state profile explore official energy statistics including data on electricity supply and.

Still solar can help with south carolina s sky high electric bills and the state s solar tax credit is among the best in the nation.

Thin film solar panels these flexible solar panels are made by spreading silicon and other solar producing materials in a very thin layer about the thickness of a human hair directly onto a large plate that is usually made of glass or ceramics.

25 of total system cost up to 35 000.

Residents of the palmetto state can claim 25 percent of their solar costs as a tax credit and if you don t pay enough in taxes to get the full value of the credit in one year it.

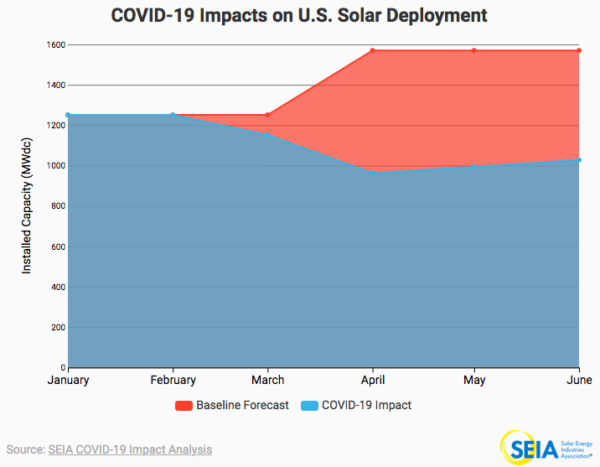

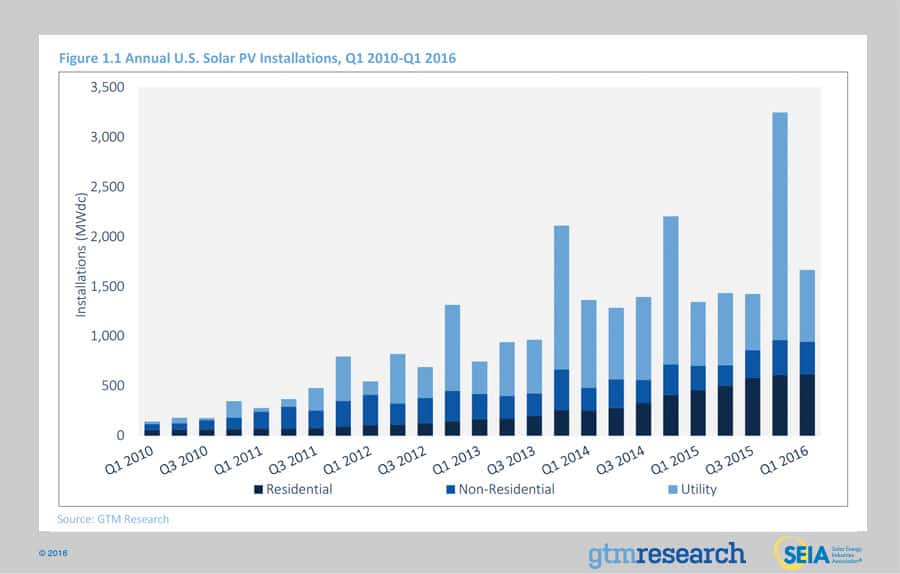

Between 2014 and 2018 the number of solar installations has grown by more than 17 000.

With the federal solar tax credit already reduced from 30 to 26 percent there s never been a better time to go solar in the palmetto state.

South carolina state legislature track pending legislation affecting solar energy locate and contact individual legislators and stay up to date on current legislative issues in south carolina u s.

The most significant incentive to install solar panels for homes and businesses is the federal solar tax credit at the end of 2020 the amount of the credit will decrease from 26 to 22 of the cost of the solar installation.

South carolina utility experience suggests normal expected efficiencies of about 16 18.

Cut the cost of installing solar on your home by a quarter with south carolina s state tax credit for solar energy.

The passage of the distributed energy resource program act act 236 in 2014 ushered in a new era of solar leasing in south carolina and solar installations have grown exponentially since that time.

A tax credit is an amount of money that can be used to offset your tax liability.

The south carolina legislature on thursday unanimously passed the energy freedom act a comprehensive solar bill that will lift the state s 2 cap on net metering among many other pro solar actions.