South carolina s tax credits may be earned by individuals c corporations s corporations partnerships sole proprietors and limited liability companies.

South carolina solar tax credit 2018.

Credits are usually used to offset corporate income tax or individual income tax.

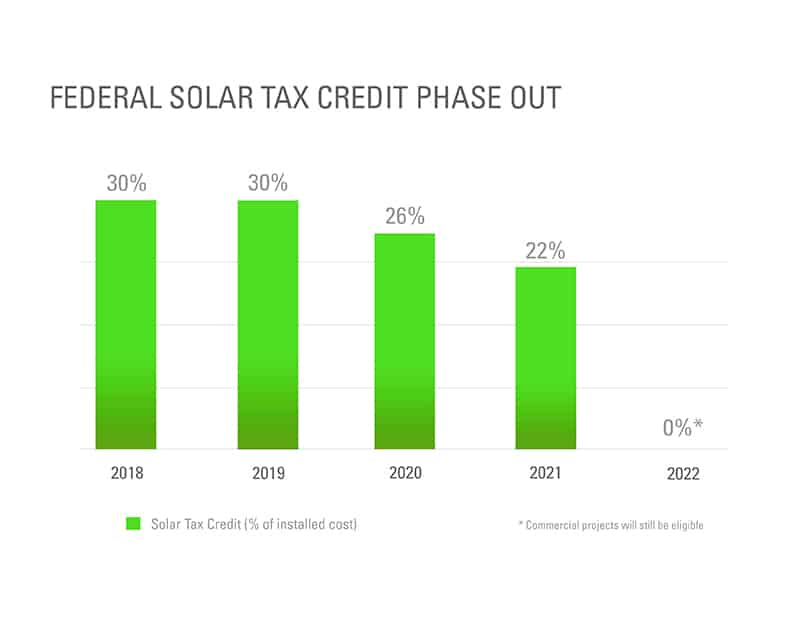

The most significant incentive to install solar panels for homes and businesses is the federal solar tax credit at the end of 2020 the amount of the credit will decrease from 26 to 22 of the cost of the solar installation.

One of the duties assigned to the energy office by the south carolina energy and efficiency act of 1992 was to serve as a central clearinghouse for information related to energy use and energy efficiency in south carolina along with federal and state energy tax incentives.

Your 5 kw solar system costs 16 250 meaning you re eligible for a state tax credit of 4 063 25 of the cost.

The south carolina solar energy tax credit is 25.

South carolina solar energy tax credit.

Cut the cost of installing solar on your home by a quarter with south carolina s state tax credit for solar energy.

25 south carolina tax credit for solar energy systems.

Here s an example of how the south carolina tax credit works.

The corresponding code.

A tax credit is an amount of money that can be used to offset your tax liability.

The state of south carolina offers an additional tax credit for home and business owners who go solar worth 25 of the total cost including installation.

Your income tax for 2018 will be 3 271 and half of that is 1 636.

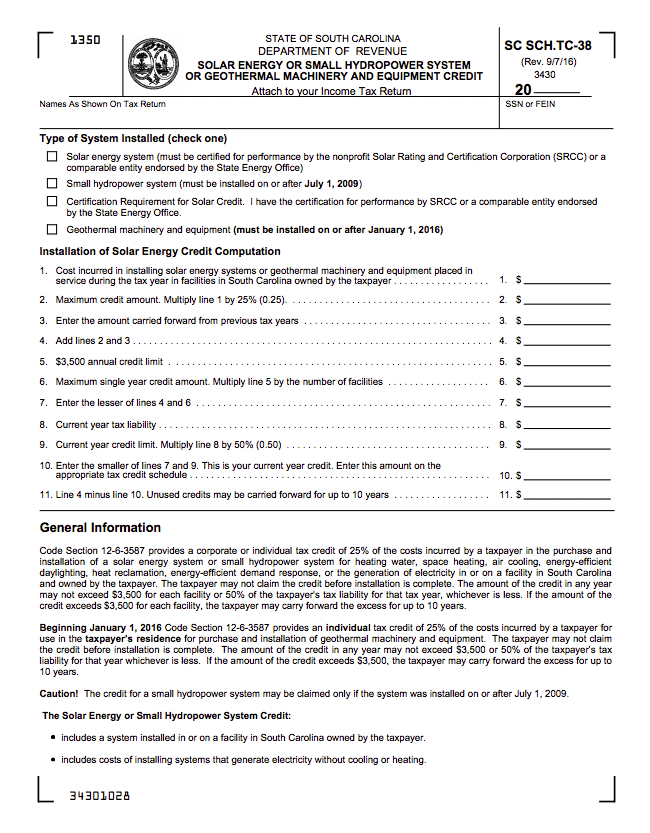

To claim the south carolina tax credit for solar you must file form sc1040tc as part of your state tax return.