Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit.

Solar panels utah tax credit.

Keep the form and all related documents with your records.

You calculate the credit on the form and then enter the result on your 1040.

To claim the credit you must file irs form 5695 as part of your tax return.

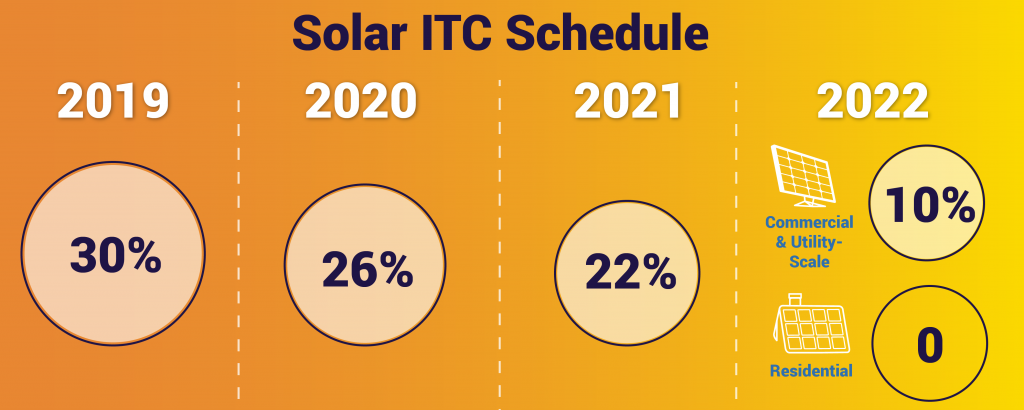

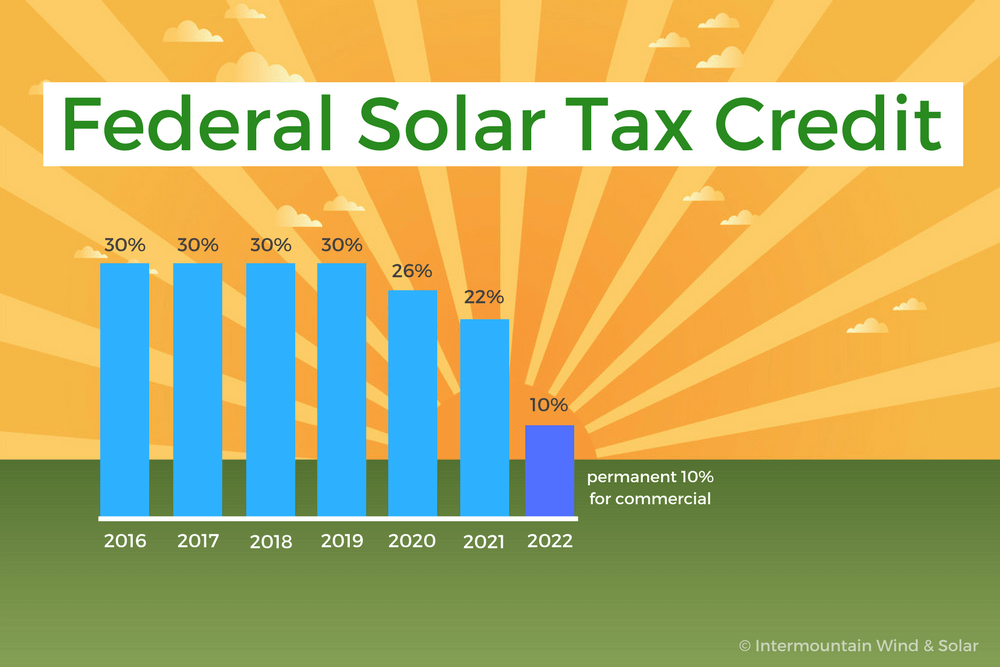

If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.

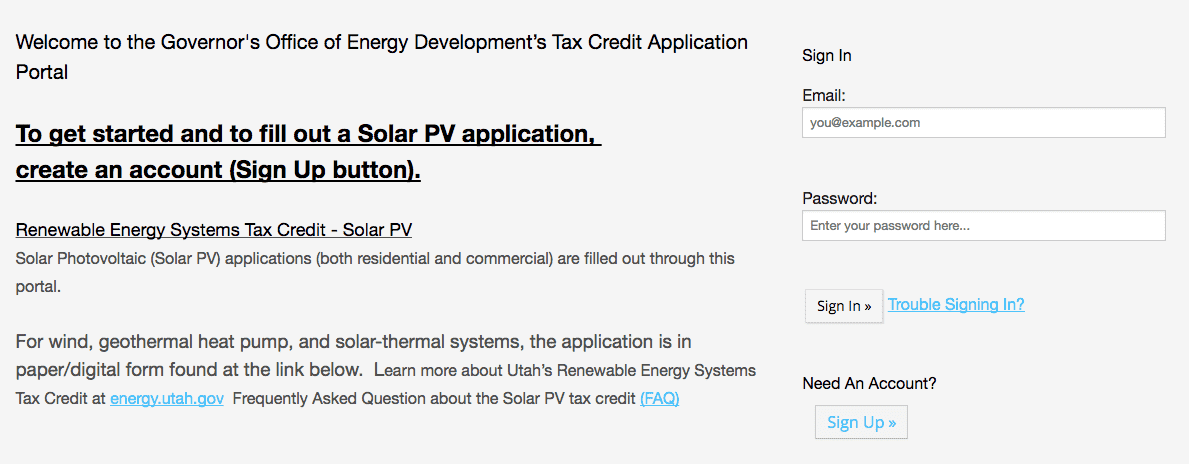

Renewable energy systems tax credit.

Renewable commercial energy systems credit code 39 utah code 59 10 1106.

Learn more and apply here.

A combination of high sun exposure the federal tax credit net metering and a state tax credit creates the potential for a terrific return on investment for homeowners who install solar panels in the beehive state.

And of course utahns also benefit from the federal solar tax credit.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

For utah solar shoppers state and local tax credits mean there s never been a better time to start exploring solar offerings.

Dolla dolla bill y all.

Whether or not you re getting any utility rebates everyone in utah is eligible to take a personal tax credit when installing solar panels.

Do not send this form with your return.

The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum of 2 000.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans.

The utah solar tax credit officially known as the renewable energy systems tax credit covers up to 25 of the purchase and installation costs for residential solar pv projects capped at 1 600 of cost whichever is less.

Utah solar power overview.

The residential energy credits are.

The state of utah is a great place to make the switch to solar.

A rooftop solar tax credit is also available for larger.

Rooftop solar for your business.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

If you install a solar panel system on your home in utah the state government will give you a credit on your next year s income.

Get form tc 40e renewable residential and commercial energy systems tax credits from the governor s office of energy development with their certification stamp.

5 minutes last updated on august 27 2020.

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/CFMREWNM2ZG4VEMDWWXDR2STH4.jpg)

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/KI7PZRE5TJBILC4QLF3SEI362Q.jpg)